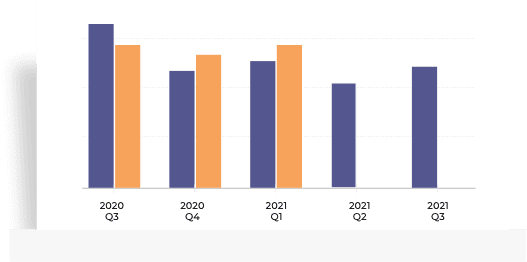

Company witnessed QoQ revenue decline of 1.5%, which is lowest in the last 3 years. (Source: Consolidated Financials)

Wipro Share Price

Wipro share price insights

Company has spent 1.11% of its operating revenues towards interest expenses and 59.42% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

Wipro Ltd. share price moved up by 0.17% from its previous close of Rs 405.35. Wipro Ltd. stock last traded price is 406.05

Share Price Value Today/Current/Last 406.05 Previous Day 405.35

Key Metrics

PE Ratio (x) | 18.18 | ||||||||||

EPS - TTM (₹) | 22.33 | ||||||||||

MCap (₹ Cr.) | 2,11,924 | ||||||||||

Sectoral MCap Rank | 4 | ||||||||||

PB Ratio (x) | 2.96 | ||||||||||

Div Yield (%) | 0.25 | ||||||||||

Face Value (₹) | 2.00 | ||||||||||

Beta Beta

| -0.13 | ||||||||||

VWAP (₹) | 405.06 | ||||||||||

52W H/L (₹) |

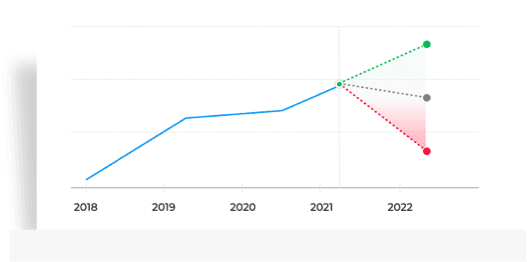

Wipro Share Price Returns

| 1 Day | 0.17% |

| 1 Week | -2.97% |

| 1 Month | -0.5% |

| 3 Months | 6.38% |

| 1 Year | 3.37% |

| 3 Years | 30.35% |

| 5 Years | 67.1% |

Wipro News & Analysis

News Diamonds in dust? RIL, HDFC Bank and Kotak Bank among 158 stocks with negative returns in 2 years

Diamonds in dust? RIL, HDFC Bank and Kotak Bank among 158 stocks with negative returns in 2 years

News Accenture earnings harbinger of bad news for 3 Indian IT stocks. Sell or hold?

Accenture earnings harbinger of bad news for 3 Indian IT stocks. Sell or hold?

News Stocks in news: Quick Heal, Infosys, Wipro, Adani Green, SBI Life, Uno Minda, Emami

Stocks in news: Quick Heal, Infosys, Wipro, Adani Green, SBI Life, Uno Minda, EmamiAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

Announcements

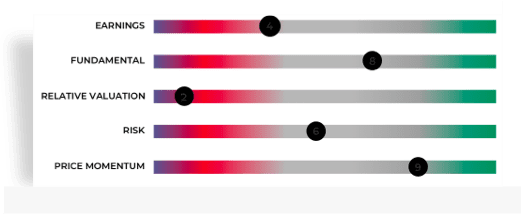

Wipro Share Recommendations

Recent Recos

Current

Mean Recos by 40 Analysts

SellSellHoldBuyStrong

Buy

That's all for Wipro recommendations. Check out other stock recos.

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 4 | 4 | 4 | 4 |

| Buy | 5 | 5 | 5 | 5 |

| Hold | 14 | 14 | 14 | 14 |

| Sell | 13 | 13 | 15 | 14 |

| Strong Sell | 4 | 4 | 3 | 3 |

| # Analysts | 40 | 40 | 41 | 40 |

Peer Comparison

Wipro Stock Performance

Ratio Performance

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...- See All Parameters

MF Ownership

296.99

Amount Invested (in Cr.)

1.04%

% of AUM

100.00

% Change (MoM basis)

ICICI Pru Technology Direct-G

Equity: Sectoral-Technology

250.24

Amount Invested (in Cr.)

2.24%

% of AUM

-13.84

% Change (MoM basis)

206.38

Amount Invested (in Cr.)

0.51%

% of AUM

0.00

% Change (MoM basis)

MF Ownership as on 31 August 2023

Wipro F&O Quote

Futures

Options

- Expiry

Price

408.600.25 (0.06%)

Open Interest

4,19,44,5005,28,000 (1.26%)

Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 409.15 411.70 404.30 408.35 6,726 41,179.86 Open Interest as of 29 Sep 2023

Corporate Actions

Wipro Board Meeting/AGM

Wipro Dividends

- Others

Meeting Date Announced on Purpose Details Oct 18, 2023 Sep 25, 2023 Board Meeting Quarterly Results Jul 13, 2023 Jul 04, 2023 Board Meeting Quarterly Results Apr 27, 2023 Apr 24, 2023 Board Meeting Audited Results & Buy Back Jan 13, 2023 Dec 23, 2022 Board Meeting Quarterly Results & Interim Dividend Oct 12, 2022 Sep 29, 2022 Board Meeting Quarterly Results Type Dividend Dividend per Share Ex-Dividend Date Announced on Interim 50% 1.0 Jan 24, 2023 Jan 13, 2023 Interim 250% 5.0 Apr 05, 2022 Mar 25, 2022 Interim 50% 1.0 Jan 21, 2022 Jan 12, 2022 Interim 50% 1.0 Jan 22, 2021 Jan 13, 2021 Interim 50% 1.0 Jan 24, 2020 Jan 14, 2020 All Types Ex-Date Record Date Announced on Details Bonus Mar 06, 2019 Mar 07, 2019 Jan 18, 2019 Bonus Ratio: 1 share(s) for every 3 shares held Bonus Jun 13, 2017 Jun 14, 2017 Apr 25, 2017 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jun 15, 2010 Jun 16, 2010 Apr 23, 2010 Bonus Ratio: 2 share(s) for every 3 shares held Bonus Aug 22, 2005 Aug 23, 2005 Apr 22, 2005 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jun 25, 2004 Jun 28, 2004 Apr 16, 2004 Bonus Ratio: 2 share(s) for every 1 shares held

About Wipro

Wipro Ltd., incorporated in the year 1945, is a Large Cap company (having a market cap of Rs 211,924.77 Crore) operating in IT Software sector. Wipro Ltd. key Products/Revenue Segments include Software Services, Networking, Storage equipment, Servers, Software Licenses for the year ending 31-Mar-2022. Show More

Executives

Auditors

- AH

Azim H Premji

Founder ChairmanRARishad A Premji

ChairmanTDThierry Delaporte

Managing Director & CEODMDeepak M Satwalekar

Independent DirectorIVIreena Vittal

Lead Independent DirectorPDPatrick Dupuis

Independent DirectorShow More - Deloitte Haskins & Sells LLP

Key Indices Listed on

Nifty 50, S&P BSE Sensex, Nifty IT, + 34 more

Address

Doddakannelli,Sarjapur Road,Bengaluru, Karnataka - 560035

More Details

Brands

FAQs about Wipro share

- 1. What is Wipro share price and what are the returns for Wipro share?As on 29 Sep, 2023, 03:59 PM IST Wipro share price was up by 0.17% basis the previous closing price of Rs 405.35. Wipro share price was Rs 406.05. Return Performance of Wipro Shares:

- 1 Week: Wipro share price moved down by 2.97%

- 1 Month: Wipro share price moved down by 0.50%

- 3 Month: Wipro share price moved up by 6.38%

- 6 Month: Wipro share price moved up by 13.09%

- 2. What has been highest price of Wipro share in last 52 weeks?52 Week high of Wipro share is Rs 443.75 while 52 week low is Rs 352.00

- 3. Who owns Wipro?Promoter,DII and FII owns 72.92, 8.01 and 6.38 shares of Wipro as on 30 Jun 2023

- Promoter holding have gone down from 72.92 (31 Mar 2023) to 72.91 (30 Jun 2023)

- Domestic Institutional Investors holding have gone down from 8.01 (31 Mar 2023) to 7.55 (30 Jun 2023)

- Foreign Institutional Investors holding have gone down from 6.38 (31 Mar 2023) to 6.32 (30 Jun 2023)

- Other investor holding has gone up from 12.69 (31 Mar 2023) to 13.22 (30 Jun 2023)

- 4. What are the key metrics to analyse Wipro Share Price?Wipro share can be quickly analyzed on following metrics:

- Stock's PE is 18.18

- Price to Book Ratio of 2.96

- Dividend Yield of 0.25

- EPS (trailing 12 month) of Wipro share is 22.33

- 5. What is the market cap of Wipro?Market Capitalization of Wipro stock is Rs 2,11,925 Cr.

- 6. Which are the key peers to Wipro?Top 4 Peers for Wipro are Tech Mahindra Ltd., HCL Technologies Ltd., Infosys Ltd. and Tata Consultancy Services Ltd.

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.