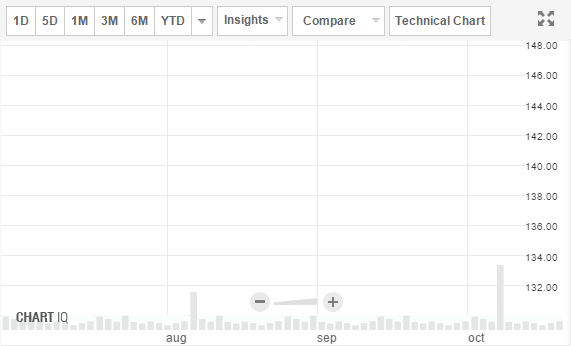

Copper Rate

(Expiry: 31-Oct-2023 | Exchange: MCX | Head: Base Metals)02.11PM IST | 02 Oct, 2023

- 722.8Per 1 KGS

- Change

3.10 (0.43%)

- Volume6357

- Open720.8

- Prv. Close719.70

- Spot727.00

Day's Trend

- Day:

- Contract:

- Average Price (Rs/1 KGS):725.05

- Open Interest (Contracts):5991

- Open Interest Change %:.00%

- Best Buy Price (Rs/QTY):722.7/2

- Prem/Disc:

- Spread:

- Unit:KGS

- Lot Size:2500

- Tick Size:5

- Best Sell Price (Rs/QTY):722.9/5

COPPER News

Why industrial commodity prices are under pressure | News

23 Sep, 2023, 02.36 PM

Going ahead, as the traditional demand drivers of industrial metals have stalled, the short-term price outlook remains under pressure. Though the new demand areas like the clean energy sector are on the cards, they are unlikely to boost prices in the immediate run.

Commodity Talk: Time to sell on rally in MCX copper, says Saish Dessai of Angel One | News

15 Sep, 2023, 01.52 PM

There's a prevailing expectation in the streets for additional stimulus measures to support the declining economy. Nevertheless, the optimism witnessed in recent weeks, which drove metals prices higher, proved short-lived as macroeconomic factors outweighed the positive indicators.

How copper prices are getting affected by complex interplay of supply and demand | News

28 May, 2023, 05.25 PM

Copper prices have fallen over 8% on the back of lower-than-anticipated demand from China, which is the largest consumer of the metal, accounting for over 50% of global consumption. Copper had been rising at the start of the year on the expectation that China’s property market would strengthen, but disappointing economic releases have weighed on the price. The industry is considered a leading indicator of global economic health and is used widely in renewable energy technologies, electronics, vehicles, and electrical grids. The US Federal Reserve's policy measures also put a dampener on business sentiment.

Commodity Talk: Copper could test $11,000 by year end; less hawkish stance may spark rally, says Saumil Gandhi | News

12 Apr, 2023, 12.07 AM

The price of copper could potentially retest $10,500 to $11,000 levels by the end of the year due to tight supply conditions and strong demand from China, according to Saumil Gandhi, senior analyst at HDFC Securities. However, in the short term, base metal prices are expected to experience further downside pressure.The long-term outlook for copper is moderately bullish, mainly due to ongoing mining supply issues in Chile and Peru and an increasing demand for copper in India as a result of higher government spending.

Multiple month breakout seen in this base metal; should one go long? | News

28 Dec, 2022, 01.17 PM

Base metals are trading with mixed directions whereas this metal is standing strong and giving breakouts. This base metal prices are increasing due to a weaker US currency and low inventory and due to the rise in COVID-19 infections with China being the main consumer and a possibility of a cut in global production.

Robust domestic demand likely to insulate copper prices in 2023 | News

24 Dec, 2022, 12.11 PM

The aggressive policy measures of the US Federal Reserve dampened business moods across the world. Many global economies are suffering from extreme inflationary trends leading to higher prices and falling demand. A contraction in business activities lowered the prospects of the metal.

Base Metals: Copper under pressure, further consolidation on cards | News

26 Nov, 2022, 05.40 PM

Prices also started the new week on a weaker note as fresh COVID-19 curbs in the top consumer, China, clouded demand outlook, while a stronger dollar added to the downbeat mood.

Top metals struggled, copper under pressure over demand concerns | News

19 Nov, 2022, 03.17 PM

FOMC member James Bullard stated the central bank needs to continue raising interest rates probably by at least another full percentage point as rate hikes have had only limited effects on inflation so far.

Expert take: How you should trade base metals next week | News

18 Sep, 2022, 02.00 PM

The recent inflation data unexpectedly beat market expectations and renewed fears that the markets could witness a hefty rate hike in September has also been pressurizing markets.At present, markets have already priced in a 75-bps hike in interest rate in September, while 24 per cent of participants expect a 100-bps hike next week.

Why industrial metals are losing their shine | News

4 Sep, 2022, 11.21 AM

In the domestic future's platform, Aluminium is the top loser, shedding prices by more than 38 per cent. Copper and Zinc declined by 28 and 24 per cent, while steel prices contracted by 21 per cent so far. A similar trend was seen in its corresponding international platforms as well.

Hot/Cold Copper Contract

COPPER (MCX)

31 October 2023

COPPER Spot Rate Details

COPPER vs Other Base Metals

Trend

D | M | YCOPPER vs Peers (Intraday Range)

LowestHighest

-0.682.45

0.43

COPPER vs Peers (Contract Range)

LowestHighest

-0.948.28

-0.40

COPPER (30-Nov-2023) vs COPPER Other Contracts

COPPER Contract Details (2023-10-31) Exchange: MCX

Symbol

COPPER

Contract Start Date

2023-06-01

Last Trading Date

2023-10-31

Lot Size

2500

Tick Size

5

Symbol Description

COPPER

Delivery Start Date

2023-10-25

Delivery End Date

2023-11-01

Symbol Info

COPPER

Tender Period Start Date

2023-10-25

Tender Period End Date

2023-10-31

Commodity Group

Base Metals

Name Of Underlying

Base Metals

Identifier of the Underlying

152

Instrument Identifier

257618

Instrument

FUTCOM

Expiry Date

2023-10-31

Price Quote Qty

KGS

Daily Price Percent

0.00

Near Month Instrument Identifier

-1

Far Month Instrument Identifier

-1

Trading Unit

KGS

Delivery Unit

KGS

COPPER Rate Historical Performance

Future Margin Calculator

This is the minimum amount which is required to buy "x" number of lots of a particular commodity to trade in futures market.

Mark-to-Market Calculator

This is daily gain/loss on the position which is taken in derivatives market, it is calculated on daily basis till the time that position is not squared off.